Chapter Eight Refresh

Welcome to the “End of Chapter Resources Page” for Chapter Eight of The Golden Albatross book. Chapter Eight is loooonnnnnngggg! Possibly the longest in the book. The only other chapter that may be longer is Chapter Nine. There are several reasons for this.

First off, Chapter Eight and Nine form the central core for learning how to value your pension correctly. A lot of factors go into making proper pension valuation calculations, and many of them are complicated. As a result, I wanted to expose you to the processes several times throughout the book. So, I laid down what I hope is a strong foundation on the basics of pension valuation in Chapter Eight, knowing that you’ll use that knowledge immediately in Chapter Nine, and in several other future chapters as well.

That said, I touched upon a lot of parallel issues in Chapter Eight but didn’t necessarily explain them in depth. I avoided in-depth explanations because it would have made the chapter even longer. With that in mind, I broke out those issues below along with links to great resources where you can learn more about them at your own pace. Enjoy!

Update (25 SEP 20)

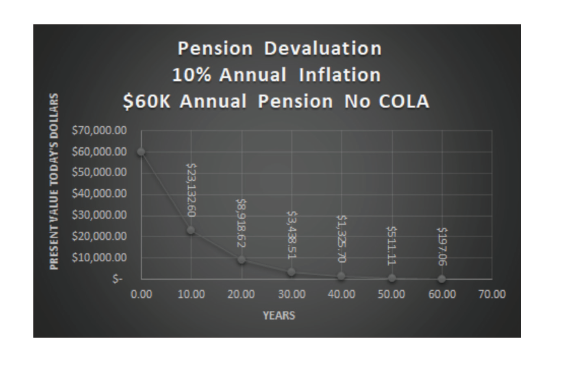

While narrating the audio book, I discovered several small typos and a few larger errors that survived the editing and review process. It sucks when mistakes make it through to the final version of a book, but it’s an inevitability that authors and publishers deal with. One of the major issues I discovered was in Chapter 8 and relates to the title of the second hockey stick graph. The title of the second graph in the hard and softcover book versions reads, “Compounding COLA Payments 10% Annual Inflation $60K Principle,” which is the intended title of the first hockey stick chart only. The second hockey stick graph’s title should read “Pension Devaluation 10% Annual Inflation $60K Annual Pension No COLA.”

To be clear, the data the second graph displays (i.e. a curve downwards from high left to low right) is correct, but the mixed-up title is completely misleading. It appears that the graphic artist forgot to change the title of the second graph when she copied the format from the first graph. That said, I missed it in my final review. I’m working with my publisher to update the e-book, and subsequent print runs of the book. However, if you have a first print run book from June/July 2020, the likelihood is that the second chart is not correctly titled. I’ve placed the correct version of the second graph, that I created for an earlier manuscript of my book, in the “Graphic References for Audio Book Listeners” section at the bottom of this page. Many apologies for the confusion!

Inflation

Everything you ever wanted to know about inflation in one web page:

Part of an academic text (which means it’s dry) that discusses inflation and the various ways to calculate inflation’s effect, depending on the situation:

My preferred inflation calculator:

Cost of Living Adjustments (COLA)

If you’re interested in building a COLA of your own because your pension payments don’t come with it, then check out my article at:

Safe Withdrawal Rates (SWR) and Sequence of Return Risk (SRR)

Here are a few links to introductory articles on SWRs and SRRs:

Wade Pfau, Ph.D., CFA. Wade is one of my three most trusted bloggers and authors who have written about SWRs and SRRs. Make sure you download his free book when you visit his page. His 4% SWR page is here:

Michael Kitces. Another of my three most trusted bloggers and authors when it comes to SWRs and SRRs. Kitces routinely writes articles about the 4% SWR like this one:

Early Retirement Now (ERN). As I mentioned in Chapter 8, Karsten (a.k.a. Big ERN) blogs extensively about SWRs and SRRs. As a matter of fact, he discovered what I call the Immediacy Effect in Chapter 8. The Immediacy Effect is the interplay between fixed income payments and SWRs late in retirement. If you like math-heavy explanations, check out his SWR Series here:

Graphic References for Audio Book Listeners

Initial Dollar Value (IDV) formulas for Grumpus Maximus’ military pension:

Golden Albatross / Golden Handcuffs Facebook Group members’ IDV formulas:

Golden Albatross / Golden Handcuffs Facebook Group members’ IDV formulas:

Bureau of Labor and Statistics (BLS) historic inflation chart referenced by Grumpus:

Two fractional deflation scenarios: